Saturday, August 26, 2006

Trading Signals of the Day

Bullish Reversal Triggers

Reversal bars are an objective technique used to time the entry of a trade. Read More... http://daily-stocks.netfirms.com/daily-trading-triggers.htm

Friday, August 25, 2006

Pattern Cycles: Trends

Read More...

The cult of Elliott Wave Theory intimidates the most experienced traders. But don't let wave voodoo stop you from adding important elements to your chart analysis. Strong trends routinely print orderly action-reaction waves. EWT uncovers these predictive patterns through their repeating count of 3 primary waves and 2 countertrend ones.

Wave impulses correspond with the crowd's emotional participation. A surging 1st Wave represents the fresh enthusiasm of an initial breakout. The new crowd then hesitates and prices drop into a countertrend 2nd Wave. This coils the action for the sudden eruption of a runaway 3rd Wave. Then after another pullback, the manic crowd exhausts itself in a final 5th Wave blowoff.

Traders can capitalize on trend waves with very little knowledge of the underlying theory. Just look for the 5-wave trend structure in all time frames. Locate smaller waves embedded in larger ones and place trades at points where two or more time frames intersect. These cross-verification zones capture major trend, reversal and breakout points...

Wave impulses correspond with the crowd's emotional participation. A surging 1st Wave represents the fresh enthusiasm of an initial breakout. The new crowd then hesitates and prices drop into a countertrend 2nd Wave. This coils the action for the sudden eruption of a runaway 3rd Wave. Then after another pullback, the manic crowd exhausts itself in a final 5th Wave blowoff.

Traders can capitalize on trend waves with very little knowledge of the underlying theory. Just look for the 5-wave trend structure in all time frames. Locate smaller waves embedded in larger ones and place trades at points where two or more time frames intersect. These cross-verification zones capture major trend, reversal and breakout points...

Read More...

Trading Tools

Shogun Swing Trading - Best Swing Trading:

Shogun Trading's approach can benefit all stock traders, from day traders to long term swing traders. We are proud to show some of the best Performance in Day Trading, Longer Term Swing Trading Strategy, Systemized Swing Trading and through our Educational Courses and Videos... » Get More Info Now!

Shogun Trading's approach can benefit all stock traders, from day traders to long term swing traders. We are proud to show some of the best Performance in Day Trading, Longer Term Swing Trading Strategy, Systemized Swing Trading and through our Educational Courses and Videos... » Get More Info Now!

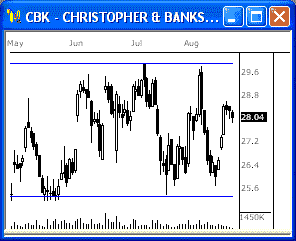

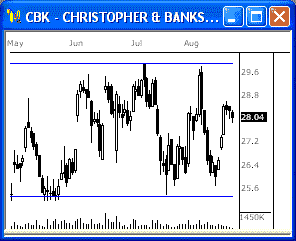

NASDAQ Chart of the Day

Daily Trading Signals

PTEN has formed a clear inverted head-and-shoulders pattern, which is a very bullish formation. An upside break through 28.00 could spark big strength from this range. Also watch 26.00 for signs of continued overall weakness.

Daily Trading Signals

NYSE Chart of the Day

Daily Trading Signals

HRL is breaking a steep lower trend line to the downside at 37.60, which is bearish. Watch for continued overall weakness from this stock.

Daily Trading Signals

Trading Education Tutorial

Reward: Risk Ratio

Assessing a Trades Potential

Read More...

Reward: Risk Ratio

Assessing a Trades Potential

When looking at a stock to buy, we look to various tools and techniques to help us assess the probability of its upward movement. However, will it go up is not the only question to ask - we also need to analyze the chart to see how far it is likely to go up and also how much of a loss we are willing to take to allow it to reach it's profit potential. The potential profit of a trade divided by the potential loss of trade is known as the Reward:Risk Ratio.

Read More...

Daily Market Commentary

Updated Thursday, 8/24 for Friday's market

Hovering at 11,300

Read More...

Updated Thursday, 8/24 for Friday's market

| Key DOW Levels for 8/25 | |

| UP | Above 11,400 |

| DN | Below 11,250 |

Hovering at 11,300

- Dow struggles in 11,300 zone, continues to wind up ahead of potential breakout. The index continues to hold above the near-term 11,250 support level, which we will continue to watch intently for continued weakness.

- The NASDAQ and S&P each traded back and forth throughout the session and have widened their respective consolidation ranges. Watch for a breakout from these ranges for key movement.

Summary

The Dow closed the day within the boundaries of a very narrow range precisely at the 11,300 fulcrum. The index continues to hold within a larger range, but a breakout from this range could lead to movement. Watch 11,400 and 11,250 tomorrow.

- The NASDAQ and S&P each traded back and forth throughout the session and have widened their respective consolidation ranges. Watch for a breakout from these ranges for key movement.

Summary

The Dow closed the day within the boundaries of a very narrow range precisely at the 11,300 fulcrum. The index continues to hold within a larger range, but a breakout from this range could lead to movement. Watch 11,400 and 11,250 tomorrow.

Read More...

Thursday, August 24, 2006

Trading Ideas & Picks

Trading Picks - Read More

RMD: Stock has broken below a long-term trendline. As you can see from the chart below, the ascending trendline has been able to prop up RMD's price several times over the past two years, but the bears managed to push the latest weekly bar below the support. The recent move below the $44 support level suggests that the long-term trend is shifting downward...

Trading Ideas & Picks

Trading Ideas - Read More

WFMI: Stock is coming off a reversal at the 20 day EMA just 4 days ago and has since entered into a consolidation with prices under the 20 day EMA. Stock traded today at the lower end of the previous day’s bearish colored candle, representing a consolidation and possible setup for further downside...

Trading Ideas - Read More

Trading Education Tutorial

Support and Resistance Leveles

History Tells Us When Securites are Overbought or Oversold

Read More...

Support and Resistance Leveles

History Tells Us When Securites are Overbought or Oversold

Support indicates a level on the chart where we can expect an increase in the demand for a security (buyers take over). How do we know this? By identifying this reaction to this price level in the chart's history.

Read More...

NASDAQ Chart of the Day

Daily Trading Signals

CENX is winding up within the boundaries of a large, triangle range, that has continued to develop since June. Look for a breakout from this range for the next key move. Watch 37.00 up, and 33.50 down.

Daily Trading Signals

NYSE Chart of the Day

Daily Trading Signals

RYL is winding up within the boundaries of a clear triangle consolidation, which could spark a big breakout move. Watch 44.50 up, and 40.50 down for the breakout.

Daily Trading Signals

Daily Market Commentary

Updated Wednesday, 8/23 for Thursday's market

Break at 11,300

Read More...

Updated Wednesday, 8/23 for Thursday's market

| Key DOW Levels for 8/24 | |

| UP | Above 11,350 |

| DN | Below 11,250 |

Break at 11,300

- Dow finally breaks 11,300 support, begins initial decline. The index's break at 11,300 is the initial spark that could send the Dow back toward the 11,100 zone yet again.

- The NASDAQ and S&P each sold off from early highs today and breached key support levels. These violations indicate that much more selling could be ahead.

Summary

The Dow ended the day beneath the key 11,300 support level after getting a solid downside break from the consolidation early in the day. This violation could be the spark that takes the Dow down for solid 200 point decline.

- The NASDAQ and S&P each sold off from early highs today and breached key support levels. These violations indicate that much more selling could be ahead.

Summary

The Dow ended the day beneath the key 11,300 support level after getting a solid downside break from the consolidation early in the day. This violation could be the spark that takes the Dow down for solid 200 point decline.

Read More...

Wednesday, August 23, 2006

Trading Signals of the Day

Bullish Reversal Triggers

Reversal bars are an objective technique used to time the entry of a trade. Read More... http://daily-stocks.netfirms.com/daily-trading-triggers.htm

Trading Ideas & Picks

Trading Ideas - Read More

AAPL: This stock is setting up a potential excellent buying opportunity. Next good buy point is after this stock puts in some horizontal work and then clears the trendline at...

Trading Ideas - Read More

NASDAQ Chart of the Day

Daily Trading Signals

DPTR is getting a solid upside break through a clear upper trend line at 19.00 via a solid breakaway gap, which is very bullish. Watch for continued upside strength from this stock.

Daily Trading Signals

NYSE Chart of the Day

Daily Trading Signals

NBR is winding up within the boundaries of a large triangle range, which is highly indicative of a pending breakout move. Watch 35.00 up, and 33.00 down for big breakout action.

Daily Trading Signals

Trading Education Tutorial

Breakaway Gaps

Pressure Helps Identify Movers

Read More...

Breakaway Gaps

Pressure Helps Identify Movers

Gaps occur when there is a dramatic change in market conditions. They can occur at the beginning of a trading session (i.e. most NASDAQ stocks) or even during the session itself. There are three types of gaps that are of interest to us when we analyze charts: breakaway, measured (also known as continuation) and exhaustion gaps. Today we will discuss the breakaway gap.

Read More...

Daily Market Commentary

Updated Tuesday, 8/22 for Wednesday's market

Still in the Range...

Read More...

Updated Tuesday, 8/22 for Wednesday's market

| Key DOW Levels for 8/23 | |

| UP | Above 11,385 |

| DN | Below 11,300 |

Still in the Range...

- Dow continues range movement within consolidation, breakout approaching. The index closed the day with a mild 5 point loss, but continues to maintain its stance above 11,300, which could bode well for an eventual upside break.

- The NASDAQ and S&P each traded relatively quietly within the boundaries of their respective consolidations today. Look for continued build-up before a breakout is seen.

Summary

The Dow closed another day within the boundaries of the very tight consolidation range that continues to form at the highs. Look for continued range movement ahead of the breakout. A breakout from this range could give us our next 200 point move.

- The NASDAQ and S&P each traded relatively quietly within the boundaries of their respective consolidations today. Look for continued build-up before a breakout is seen.

Summary

The Dow closed another day within the boundaries of the very tight consolidation range that continues to form at the highs. Look for continued range movement ahead of the breakout. A breakout from this range could give us our next 200 point move.

Read More...

Technical Indicators

Ultimate Oscillator

Read More...Developed by Larry Williams, the Ultimate Oscillator combines a stock's price action during three different time frames into one bounded oscillator. The three time frames represent short, intermediate, and long term market cycles (7, 14, & 28-period). Note that these time periods all overlap, the 28-period time frame includes both the 14-period time frame and the 7-period time frame. This means that the action of the shortest time frame is included in the calculation three times and has a magnified impact on the results.

It is expressed as a single line plotted on a vertical range valued between 0 and 100, with oversold territory below 30 and overbought territory above 70...

It is expressed as a single line plotted on a vertical range valued between 0 and 100, with oversold territory below 30 and overbought territory above 70...

Tuesday, August 22, 2006

NASDAQ Chart of the Day

Daily Trading Signals

CONR is winding up within the boundaries of a very large triangle range that has continued to develop over the last five months. A breakout from this range will very likely spark big movement in terms of the next key trend. Watch 28.00 up, and 24.75 down.

Daily Trading Signals

NYSE Chart of the Day

Daily Trading Signals

EDS is winding up within the boundaries of a clear triangle consolidation, which we will watch closely for a solid breakout. Watch 24.25 up, and 23.15 down.

Daily Trading Signals

Trading Education Tutorial

Trading Ranges

Big Moves Occur Outside of the Range

Read More...

Trading Ranges

Big Moves Occur Outside of the Range

OA trading range is basically a horizontal channel in which a security moves from the high and low of the channel for an extended amount of time. Obviously, the upper level of the range can be considered resistance and the lower level represents support. Trading within a range is possible, but it's the breakout from the range that provides the best opportunities.

Read More...

Daily Market Commentary

Updated Monday, 8/21 for Tuesday's market

Still Consolidating...

Read More...

Updated Monday, 8/21 for Tuesday's market

| Key DOW Levels for 8/22 | |

| UP | Above 11,400 |

| DN | Below 11,300 |

Still Consolidating...

- Dow pulls back from highs, trades sideways to the Close. The index closed the day with a 36 point loss, but continues to trade within the boundaries of the key consolidation that we will continue to watch.

- The NASDAQ and S&P each traded slowly sideways today, as further development of their respective consolidations resumes. Look for a breakout from these ranges for directional movement.

Summary

The Dow closed the day lower, but continues to develop within the boundaries of the key consolidation, which we will continue to focus on. Look for continued range movement until a solid breakout from this range is seen. Such a breakout could make for nice movement.

- The NASDAQ and S&P each traded slowly sideways today, as further development of their respective consolidations resumes. Look for a breakout from these ranges for directional movement.

Summary

The Dow closed the day lower, but continues to develop within the boundaries of the key consolidation, which we will continue to focus on. Look for continued range movement until a solid breakout from this range is seen. Such a breakout could make for nice movement.

Read More...

Monday, August 21, 2006

Daily Stock Picks

Bottoming -

Aug 18 for Aug 21:

BTRX FLWS INWK MACE RDEN TALK

(Stocks making a 52 WK low but closing higher than they opened)

Oversold Stocks -

Aug 18 for Aug 21:

NCVTX FLOW

(Stocks closing higher than they opened, crossing up through their 25 Stochastic level, and on 150% + greater than average 6 month volume)

Overreaction -

Aug 18 for Aug 21:

AHCI ESST OTIV

(Potential Bullish Bounce: Stocks making a 52 WK low and moving down 10% or more in one day)

More... Stock Picks Page #1

Bottoming -

Aug 18 for Aug 21:

BTRX FLWS INWK MACE RDEN TALK

(Stocks making a 52 WK low but closing higher than they opened)

Oversold Stocks -

Aug 18 for Aug 21:

NCVTX FLOW

(Stocks closing higher than they opened, crossing up through their 25 Stochastic level, and on 150% + greater than average 6 month volume)

Overreaction -

Aug 18 for Aug 21:

AHCI ESST OTIV

(Potential Bullish Bounce: Stocks making a 52 WK low and moving down 10% or more in one day)

More... Stock Picks Page #1

NASDAQ Chart of the Day

Daily Trading Signals

FMCN is winding up within a large triangle range and took a breakaway gap down today. The stock is headed toward the bottom of the range and a breakout through 56.00 could spell weakness.

Daily Trading Signals

NYSE Chart of the Day

Daily Trading Signals

FDO took a large gap up this morning, but immediately filled the gap to the downside to close the day with a loss. This exhaustion gap could be a precursor to big weakness ahead. Watch 24.50 for continued weakness.

Daily Trading Signals

Daily Market Commentary

Updated Friday, 8/18 for Monday's market

Still Holding...

Read More...

Updated Friday, 8/18 for Monday's market

| Key DOW Levels for 8/21 | |

| UP | Above 11,400 |

| DN | Below 11,300 |

Still Holding...

- Dow continues range movement at highs, resumes development of consolidation. The index gained 47 points for the day, but continues to honor the boundaries of the consolidation, which we will continue to watch for further developement.

- The NASDAQ and S&P each reversed from early lows, but ended the day strong today. The tech-heavy index continues to wind up within its consolidation range; while the S&P is testing new highs. Look for continued overall strength above near-term support.

Summary

The Dow ended the day within the boundaries of the developing consolidation. Look for more range behavior as the index gears up for the next key breakout move. A break back below 11,300 will give us an early signal of weakness next week.

- The NASDAQ and S&P each reversed from early lows, but ended the day strong today. The tech-heavy index continues to wind up within its consolidation range; while the S&P is testing new highs. Look for continued overall strength above near-term support.

Summary

The Dow ended the day within the boundaries of the developing consolidation. Look for more range behavior as the index gears up for the next key breakout move. A break back below 11,300 will give us an early signal of weakness next week.

Read More...

Trading Education Tutorial

Moving Averages and the Trend

Moving Averages Help Us Identify Trend Reversals

Read More...

Moving Averages and the Trend

Moving Averages Help Us Identify Trend Reversals

One of the old axioms of technical analysis is that 'the trend is your friend'. This holds true, as long as you trade in the direction of the trend. However, your 'friend' has two faces, and can turn on you to eliminate profits (and your friendship!). Trend reversals can occur at any time and one of the important skills a trader must possess is the ability to identify a reversal. It is easy to exit a position too early if we over-anticipate a trend reversal, and just as easy to watch our profits evaporate if we are too slow to exit the trade.

Read More...

Trading Ideas & Picks

Trading Ideas - Read More

The market was in a down trend for 3 months, a quick bounce is exciting, but it is new and untested. Many people call it the "Thank Goodness" rally. If someone was holding a position that has been moving against them for three months, they would use this rally to cover a bit higher than worst case, so they say "thank Goodness". In my opinion, this is the real thing, it is developing into a real up trend. After the initial pull back, the market will confirm the new up trend, establish a really solid bottom, and then we will get the real up trend...

Trading Ideas - Read More