Friday, September 08, 2006

Technical Indicators

Price Volume Rank

Read More...Price Volume Rank is a simple analysis developed by Anthony Macek using just two sets of data, Price and Volume.

Macek describes the indicator as, "for those with neither the time nor the inclination to master the techniques necessary to monitor every blip and sputter that the market produces...."

Macek describes the indicator as, "for those with neither the time nor the inclination to master the techniques necessary to monitor every blip and sputter that the market produces...."

NASDAQ Chart of the Day

Daily Trading Signals

EBAY has trended steadily lower beneath a major upper trend line that has formed across the highs since January. The index is currently showing weakness from this line at 29.00, which could lead to another steady decline from this third touch. Watch for weakness away from this line, unless 29.00 is solidly broken to the upside.

Daily Trading Signals

NYSE Chart of the Day

NEM is getting a big downside break out a tightly-wound triangle range via a breakaway gap, which is quiet bearish. Look for continued weakness out of this range ahead.

Daily Trading Signals

NEM is getting a big downside break out a tightly-wound triangle range via a breakaway gap, which is quiet bearish. Look for continued weakness out of this range ahead.

Daily Trading Signals

Trading Signals of the Day

Bullish Reversal Triggers

Reversal bars are an objective technique used to time the entry of a trade. Read More... http://daily-stocks.netfirms.com/daily-trading-triggers.htm

Trading Education Tutorial

Moving Averages and the Trend

Moving Averages Help Us Identify Trend Reversals

Read More...

Moving Averages and the Trend

Moving Averages Help Us Identify Trend Reversals

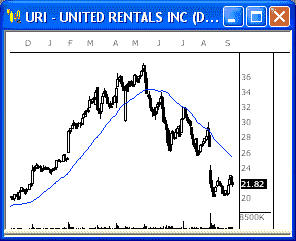

One of the old axioms of technical analysis is that 'the trend is your friend'. This holds true, as long as you trade in the direction of the trend. However, your 'friend' has two faces, and can turn on you to eliminate profits (and your friendship!). Trend reversals can occur at any time and one of the important skills a trader must possess is the ability to identify a reversal. It is easy to exit a position too early if we over-anticipate a trend reversal, and just as easy to watch our profits evaporate if we are too slow to exit the trade.

Read More...

Daily Market Commentary

Updated Thursday, 9/7 for Friday's market

Lower High

Read More...

Updated Thursday, 9/7 for Friday's market

| Key DOW Levels for 9/8 | |

| UP | Above 11,400 |

| DN | Below 11,300 |

Lower High

- Dow pulls back to 11,400 and then drops to new lows. The index later rallied from lows, but halted the advance just below 11,400 before falling to new lows to the Close, ending the day down by 75 points.

- The NASDAQ and S&P each sold off early, followed by late-day weakness. Look for each to continue to push lower in the medium term, especially if today's highs are not breached.

Summary

The Dow closed the day with a solid loss after breaking a key lower trend line and forming a lower high in the process. Much more weakness could be ahead, especially if 11,300 is solidly crossed. Watch 11,400 for early signs of strength.

- The NASDAQ and S&P each sold off early, followed by late-day weakness. Look for each to continue to push lower in the medium term, especially if today's highs are not breached.

Summary

The Dow closed the day with a solid loss after breaking a key lower trend line and forming a lower high in the process. Much more weakness could be ahead, especially if 11,300 is solidly crossed. Watch 11,400 for early signs of strength.

Read More...

Thursday, September 07, 2006

Technical Indicators

Ease of Movement

Read More...The Ease of Movement Indicator was designed to illustrate the relationship between volume and price change. It shows how much volume is required to move prices.

High Ease of Movement values occur when prices are moving upward with light volume. Low values occur when prices are moving downward on light volume. If prices are not moving or if heavy volume is required to move prices then the indicator will read near zero.

A buy signal is produced when it crosses above zero (an indication that prices are more easily moving upward ). A sell signal is produced when the indicator crosses below zero (prices are moving downward more easily)...

High Ease of Movement values occur when prices are moving upward with light volume. Low values occur when prices are moving downward on light volume. If prices are not moving or if heavy volume is required to move prices then the indicator will read near zero.

A buy signal is produced when it crosses above zero (an indication that prices are more easily moving upward ). A sell signal is produced when the indicator crosses below zero (prices are moving downward more easily)...

NASDAQ Chart of the Day

Daily Trading Signals

IMOS has formed a very beautiful saucer pattern at the lows of the latest decline. This pattern has a lot of bullish potential and could really pack a punch to the upside. Watch 6.40 for signs of strength ahead.

Daily Trading Signals

NYSE Chart of the Day

Daily Trading Signals

ECL has broken a very clear and solid lower trend line to the downside at 44.00. The stock also took a breakaway gap down, which adds to the bearish potential of this stock. Look for continued weakness below 44.50.

Daily Trading Signals

Daily Market Commentary

Updated Wednesday, 9/6 for Thursday's market

Back at 11,400

Read More...

Updated Wednesday, 9/6 for Thursday's market

| Key DOW Levels for 9/7 | |

| UP | Above 11,450 |

| DN | Below 11,380 |

Back at 11,400

- Dow sells off from highs, closes back at key 11,400 fulcrum. The index ended the day with a 63 point loss, but could be on the verge of a much bigger decline ahead.

- The NASDAQ and S&P each sold off heavily to begin the day, but continued with selling pressure to the Close. Look for potential continuation patterns to form to indicate continued weakness.

Summary

The Dow ended the day with a solid loss today, but is currently holding at the key 11,400 fulcrum. Watch this zone for early direction tomorrow. A break of the major lower trend line at 11,380 could really open the gates for the bears.

- The NASDAQ and S&P each sold off heavily to begin the day, but continued with selling pressure to the Close. Look for potential continuation patterns to form to indicate continued weakness.

Summary

The Dow ended the day with a solid loss today, but is currently holding at the key 11,400 fulcrum. Watch this zone for early direction tomorrow. A break of the major lower trend line at 11,380 could really open the gates for the bears.

Read More...

Trading Education Tutorial

Consolidations

Sideways Movement Gives Indication of Future Price Direction

Read More...

Consolidations

Sideways Movement Gives Indication of Future Price Direction

A consolidation is a place where buyers and sellers are very closely matched in numbers. As the battle ensues, others notice that the market is consolidating, and begin considering to get on board. As soon as a break from the consolidation occurs, the latent buyers or sellers usually begin taking positions.

Read More...

Wednesday, September 06, 2006

Trading Education Tutorial

Pattern Cycles: Reversals

Read More...

Pattern Cycles: Reversals

No chart pattern better illustrates this slow evolution from bull market to bear decline than the Descending Triangle. Within this simple structure, the trader examines how life drains slowly from a dynamic uptrend. Variations of this destructive formation precede more breakdowns than any other reversal. And they can be found doing their dirty deeds in all time frames and all markets.

But why does it work with such deadly accuracy? Most traders don't understand how or why patterns predict outcomes. Some even believe these important tools rely on mysticism or convenient curve fitting. The simple truth is more powerful: congestion patterns reflect the impact of crowd psychology on changes in price and momentum...

But why does it work with such deadly accuracy? Most traders don't understand how or why patterns predict outcomes. Some even believe these important tools rely on mysticism or convenient curve fitting. The simple truth is more powerful: congestion patterns reflect the impact of crowd psychology on changes in price and momentum...

Read More...

Profits Run

Instant Profits

Read More..."Instant Profits" - Step-By-Step Trading Course. Get the first 5 Chapters of this groundbreaking trading course, FOR FREE!

Super Divergence BlueprintDiscover Hidden Trades With Astonishing Simplicity. Hurry, Get Your Free "Sneak Preview" Of "Profits Run" Trading "Blueprint".

Stock Trading Advisory Service

Daily Stock Trading Recommendations That Tell You Exactly Which Stocks To Buy & Sell... Try it for 30 days for just $1!

Daily Stock Picks

Volume Pop -

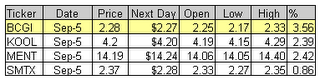

Sep 5 for Sep 6:

CHTR CMOS CRGN CYTR OSCI

(Increased Volume > 200% of 6mo Average with overall strenght)

Oversold Stocks -

Sep 5 for Sep 6:

ACXM

(Stocks closing higher than they opened, crossing up through their 25 Stochastic level, and on 150% + greater than average 6 month volume)

Overreaction -

Sep 5 for Sep 6:

GNTA PGWC SGXP

(Potential Bullish Bounce: Stocks making a 52 WK low and moving down 10% or more in one day)

More... Stock Picks Page #1

Volume Pop -

Sep 5 for Sep 6:

CHTR CMOS CRGN CYTR OSCI

(Increased Volume > 200% of 6mo Average with overall strenght)

Oversold Stocks -

Sep 5 for Sep 6:

ACXM

(Stocks closing higher than they opened, crossing up through their 25 Stochastic level, and on 150% + greater than average 6 month volume)

Overreaction -

Sep 5 for Sep 6:

GNTA PGWC SGXP

(Potential Bullish Bounce: Stocks making a 52 WK low and moving down 10% or more in one day)

More... Stock Picks Page #1

Daily Market Commentary

Updated Tuesday, 9/5 for Wednesday's market

Holding..

Read More...

Updated Tuesday, 9/5 for Wednesday's market

| Key DOW Levels for 9/6 | |

| UP | Above 11,500 |

| DN | Below 11,375 |

Holding..

- Dow trades back and forth throughout session, holds above major 11,400 zone. The index continues to hold confidently above the 11,400 resistance level and the major lower trend line, which we will continue to watch.

- The NASDAQ and S&P each pushed higher today, extending their overall advance from last week. Watch near-term support for direction tomorrow.

Summary

The Dow closed the day fairly quietly and continues to hold above key resistance at 11,400. Continued overall near-term strength is likely above this zone, unless it is solidly crossed. Use this level as our near-term fulcrum tomorrow.

- The NASDAQ and S&P each pushed higher today, extending their overall advance from last week. Watch near-term support for direction tomorrow.

Summary

The Dow closed the day fairly quietly and continues to hold above key resistance at 11,400. Continued overall near-term strength is likely above this zone, unless it is solidly crossed. Use this level as our near-term fulcrum tomorrow.

Read More...

Trading Education Tutorial

Consolidations

Sideways Movement Gives Indication of Future Price Direction

Read More...

Consolidations

Sideways Movement Gives Indication of Future Price Direction

A consolidation is a place where buyers and sellers are very closely matched in numbers. As the battle ensues, others notice that the market is consolidating, and begin considering to get on board. As soon as a break from the consolidation occurs, the latent buyers or sellers usually begin taking positions.

Read More...

Tuesday, September 05, 2006

Trading Tools

Shogun Swing Trading - Best Swing Trading:

Shogun Trading's approach can benefit all stock traders, from day traders to long term swing traders. We are proud to show some of the best Performance in Day Trading, Longer Term Swing Trading Strategy, Systemized Swing Trading and through our Educational Courses and Videos... » Get More Info Now!

Shogun Trading's approach can benefit all stock traders, from day traders to long term swing traders. We are proud to show some of the best Performance in Day Trading, Longer Term Swing Trading Strategy, Systemized Swing Trading and through our Educational Courses and Videos... » Get More Info Now!

Trading Ideas & Picks

Trading Ideas - Read More

The indexes have broken above resistance last week. If this is confirmed this week, after the holiday has passed, we may be in the continuation of the up trend. Make sure you wait for the confirmation, since moves made on low volume should not be trusted as much. The market looks like it is ready for a rotation into a defensive position...

Trading Ideas - Read More

Trading Ideas & Picks

Trading Picks - Read More

QQQQ: This week we've identified an interesting inverse head and shoulders pattern on the chart of the QQQQ. Friday's move above the resistance will likely be used by traders to signal a move toward the next resistance near the 200 DMA...

NASDAQ Chart of the Day

Daily Trading Signals

ZGEN has formed a clear head-and-shoulders pattern at the current highs and has gotten a breakaway gap just days ago that is yet to push the stock lower. A downside break through the neck line of the HS at 19.00 could spark big selling in this stock.

Daily Trading Signals

NYSE Chart of the Day

Daily Trading Signals

HON is winding up within a very nice triangle conslidation. A breakout from this range in either direction should spark a steady move in the direction of the break. Watch 39.75 up, and 38.00 down.

Daily Trading Signals

Trading Education Tutorial

Saucer Patterns

Rare Pattern Is One of the Most Predictive

Read More...

Saucer Patterns

Rare Pattern Is One of the Most Predictive

One of the most predicitive chart patterns you will come across is the saucer pattern. Saucers are also referred to as "bowls" or even "rounded tops or bottoms", and one look at this pattern tells where these names are derived from. However, there is a problem with saucer patterns - they're hard to find.

Read More...

Daily Market Commentary

Updated Friday, 9/1 for Monday's market

Big Breakout

Read More...

Updated Friday, 9/1 for Monday's market

| Key DOW Levels for 9/5 | |

| UP | Above 11,500 |

| DN | Below 11,350 |

Big Breakout

- Dow breaks through key resistance at 11,400, rallies to the Close. The index powered higher to the Close for a big gain and is holding firmly above major resistance.

- The NASDAQ and S&P each pushed steadily higher today after breaking out to new highs. Look for continuation patterns to form to indicate continued overall strength.

Summary

The Dow closed the day at the highs of the session after getting a solid breakout through 11,400 to begin the day. The index continues to push higher within the current overall uptrend and will likely continue to do so until the major lower trend line is violated at 11,350. Watch this line closely.

- The NASDAQ and S&P each pushed steadily higher today after breaking out to new highs. Look for continuation patterns to form to indicate continued overall strength.

Summary

The Dow closed the day at the highs of the session after getting a solid breakout through 11,400 to begin the day. The index continues to push higher within the current overall uptrend and will likely continue to do so until the major lower trend line is violated at 11,350. Watch this line closely.

Read More...